Дивиденды, акции, портфели и тренажеры ФСФР

Дивидендные портфели

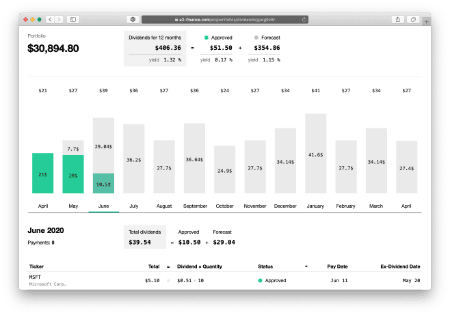

Дивидендный портфель показывает, сколько дивидендов можно получить в ближайшие 12 месяцев. Это очень простой прогноз, но даёт понимание общей картины, а также помогает грамотно выстраивать денежный поток (это подобно купонам в облигациях).

Также, инструмент поможет составить такие портфели акций, которые будут приносить дивиденды каждый месяц.

Да, в этом году много компаний отменили дивиденды, поэтому прогноз иногда может быть ошибочным, но ведь скоро всё наладится, не так ли?

Пример портфеля Новый портфель

Лучшие дивидендые компании

🇺🇸 США

| DY | |||

|---|---|---|---|

| 🏆 | Union Pacific | 2,6 % | |

| 🥈 | Royal Bank of Canada | 2,9 % | |

| 🥉 | Amgen | 2,7 % | |

| U.S. Bancorp | 3,8 % | ||

| Altria | 6,4 % | ||

| Colgate-Palmolive | 2,4 % | ||

| Schlumberger NV | 2,3 % | ||

| Sempra Energy | 2,8 % | ||

| Aflac | 2,2 % | ||

| Skyworks Solutions | 4,9 % |

🇯🇵 Япония

| DY | |||

|---|---|---|---|

| 🏆 | Japan Tobacco | 2,3 % | |

| 🥈 | Sekisui House | 2,1 % | |

| 🥉 | Ono Pharmaceutical | 2,3 % | |

| Isuzu Motors | 2,5 % | ||

| Meiji | 2,7 % | ||

| Koei Tecmo | 2,3 % | ||

| Tosoh | 2,3 % | ||

| NSK | 2,2 % | ||

| NH Foods | 2,7 % | ||

| DIC | 4,1 % |

🇬🇧 UK

| DY | |||

|---|---|---|---|

| 🏆 | ЛУКОЙЛ | 5,4 % | |

| 🥈 | EVN | 3,2 % | |

| 🥉 | Loomis | 3,8 % | |

| Fuchs Petrolub | 3,0 % | ||

| Keurig Dr Pepper | 0,7 % | ||

| Princess Private Equity | 3,4 % | ||

| Tufton Oceanic Assets | 2,2 % | ||

| Bouvet | 1,2 % | ||

| Toyota Motor | 2,2 % | ||

| Ashtead | 0,0 % |

🇩🇪 Германия

| DY | |||

|---|---|---|---|

| 🏆 | Continental | 4,1 % | |

| 🥈 | Traton | 2,9 % | |

| 🥉 | Commerzbank | 3,5 % | |

| GEA Group | 4,0 % | ||

| GEA Group | 3,9 % | ||

| Jungheinrich | 2,1 % | ||

| JOST Werke | 2,8 % | ||

| Merkur Bank | 2,7 % | ||

| Bastei Lübbe | 5,6 % | ||

| EON | 7,0 % |

Топ-10 дивидендов на ближайшую неделю

все предстоящие дивиденды здесь| Тикер | Компания | Див.доходн (trailing) | Див.доходн (forward) | Эксдивидендная дата | Цена | Капитализация |

|---|---|---|---|---|---|---|

| ARR | ARMOUR Residential REIT | 39,83 % | 3,32 % | 16 март | 7,23 $ | 893 M |

| OCSL | Oaktree Specialty Lending | 25,22 % | 5,97 % | 16 март | 6,7 $ | 1 B |

| SPOK | Spok Holdings | 19,98 % | 4,99 % | 16 март | 6,26 $ | 188 M |

| CSWC | Capital Southwest | 15,66 % | 1,35 % | 13 март | 18,78 $ | 634 M |

| PNNT | PennantPark Investment | 15,24 % | 1,27 % | 16 март | 6,3 $ | 466 M |

| FSK | FS KKR Capital | 14,14 % | 2,27 % | 18 март | 19,8 $ | 6 B |

| WEYS | Weyco Group | 12,35 % | 4,34 % | 13 март | 24,86 $ | 240 M |

| GECC | Great Elm Capital | 11,65 % | 2,36 % | 16 март | 12,7 $ | 93 M |

| OXSQ | Oxford Square Capital | 11,54 % | 0,96 % | 17 март | 3,64 $ | 204 M |

| SLRC | Solar Capital | 10,88 % | 2,72 % | 13 март | 15,07 $ | 804 M |

Калькуляторы

Акции и облигации

Инвестирование

Дивиденды

Отзывы

超愛這個網站的圖表~.

강력한 계산기능과 더 나은 디자인 그리고 캘린더와 배당 포트폴리오 짜기에도 훨씬 편리한 곳이 있습니다. 엑셀파일로의 추출까지 지원합니다. 배당일 카운트다운 기능도 있어서 재미도 있습니다.

I was pleased to see that a lot of information was published for free. I didn't immediately understand where the dividend portfolios were, but after a few minutes I found them.

Идеально для новичков вроде меня, которые только присматриваются к такому способу заработка.