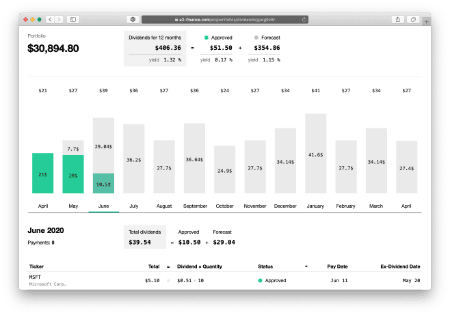

Des informations sur les dividendes, les actions et la gestion des portefeuille d'investissements

Portefeuille de dividendes

Le portefeuille de dividendes indique combien de dividendes vous pouvez obtenir au cours des 12 prochains mois. C'est une estimation très simple, mais qui permet d'avoir une vision d'ensemble, et qui vous aide également à bien gérer votre cash flow (de la même manière qu'un coupon d'obligation).

De plus, l'outil peut aussi regrouper des portefeuilles de titres qui vont générer des dividendes chaque mois.

Effectivement, beaucoup de compagnies ont éradiqué les dividendes. Par conséquent, les prévisions peuvent quelquefois être erronées, mais les choses vont s'améliorer, pas vrai?

Portefeuille simple Nouveau portefeuille

Meilleures sociétés de dividendes

🇺🇸 États-Unis

| DY | |||

|---|---|---|---|

| 🏆 | Home Depot | 2,6 % | |

| 🥈 | AbbVie | 4,5 % | |

| 🥉 | Union Pacific | 2,6 % | |

| Medtronic | 3,1 % | ||

| Amgen | 2,7 % | ||

| U.S. Bancorp | 3,8 % | ||

| Altria | 7,4 % | ||

| Illinois Tool Works | 2,6 % | ||

| Colgate-Palmolive | 2,4 % | ||

| Schlumberger NV | 2,3 % |

🇯🇵 Japon

| DY | |||

|---|---|---|---|

| 🏆 | Japan Tobacco | 2,3 % | |

| 🥈 | Sekisui House | 2,1 % | |

| 🥉 | Ono Pharmaceutical | 2,3 % | |

| Isuzu Motors | 2,5 % | ||

| Meiji | 2,7 % | ||

| Koei Tecmo | 2,3 % | ||

| Tosoh | 2,3 % | ||

| NSK | 2,2 % | ||

| NH Foods | 2,7 % | ||

| DIC | 4,1 % |

🇬🇧 UK

| DY | |||

|---|---|---|---|

| 🏆 | LUKOIL | 5,4 % | |

| 🥈 | EVN | 4,1 % | |

| 🥉 | Loomis | 3,8 % | |

| Fuchs Petrolub | 3,0 % | ||

| Keurig Dr Pepper | 0,7 % | ||

| Princess Private Equity | 3,4 % | ||

| Tufton Oceanic Assets | 2,2 % | ||

| Bouvet | 1,2 % | ||

| Toyota Motor | 2,2 % | ||

| Ashtead | 0,0 % |

🇩🇪 Allemagne

| DY | |||

|---|---|---|---|

| 🏆 | GEA Group | 3,5 % | |

| 🥈 | Jungheinrich | 2,1 % | |

| 🥉 | JOST Werke | 2,8 % | |

| Merkur Bank | 2,7 % | ||

| Bastei Lübbe | 5,6 % | ||

| Andritz | 6,7 % | ||

| Siemens | 5,6 % | ||

| Siemens | 5,6 % | ||

| Vossloh | 3,6 % | ||

| Fuchs Petrolub | 3,4 % |

Top 10 des dividendes à venir de la semaine

Tous les dividendes à venir apparaissent ici| Ticker | Nom d'entreprise | Rendement antérieur | Rendement à terme | Date ex-dividende | Cours de clôture | Capitalisation boursière |

|---|---|---|---|---|---|---|

| BLX | Banco Latinoamericano de Comercio Exterior SA | 23,15 % | 5,09 % | 25 fév. | 13,5 $ | 648 M |

| BLX | Banco Latinoamericano de Comercio Exterior SA | 23,15 % | 5,09 % | 23 fév. | 13,5 $ | 648 M |

| ITUB | Itaú Unibanco | 13,68 % | 0,08 % | 26 fév. | 4,25 $ | 40 B |

| HTGC | Hercules Capital | 13,42 % | 3,35 % | 25 fév. | 14,01 $ | 2 B |

| GSL | Global Ship Lease | 13,08 % | 3,85 % | 24 fév. | 16,24 $ | 847 M |

| DX | Dynex Capital | 12,50 % | 12,62 % | 23 fév. | 16,16 $ | 629 M |

| TLF | Tandy Leather Factory | 9,94 % | 3,31 % | 25 fév. | 22,63 $ | 27 M |

| MNR | Monmouth Real Estate Investment | 9,25 % | 2,53 % | 26 fév. | 20,98 $ | 2 B |

| RHI | Robert Half International | 9,11 % | 2,28 % | 25 fév. | 25,9 $ | 13 B |

| AB | AllianceBernstein Holding LP | 8,23 % | 2,28 % | 20 fév. | 42,15 $ | 5 B |

Calculatrices

Actions et obligations

Investir

Dividendes

Avis

超愛這個網站的圖表~.

강력한 계산기능과 더 나은 디자인 그리고 캘린더와 배당 포트폴리오 짜기에도 훨씬 편리한 곳이 있습니다. 엑셀파일로의 추출까지 지원합니다. 배당일 카운트다운 기능도 있어서 재미도 있습니다.

I was pleased to see that a lot of information was published for free. I didn't immediately understand where the dividend portfolios were, but after a few minutes I found them.

Идеально для новичков вроде меня, которые только присматриваются к такому способу заработка.