Latest updated dividend data: 08 Jul 22:35

Dividend History

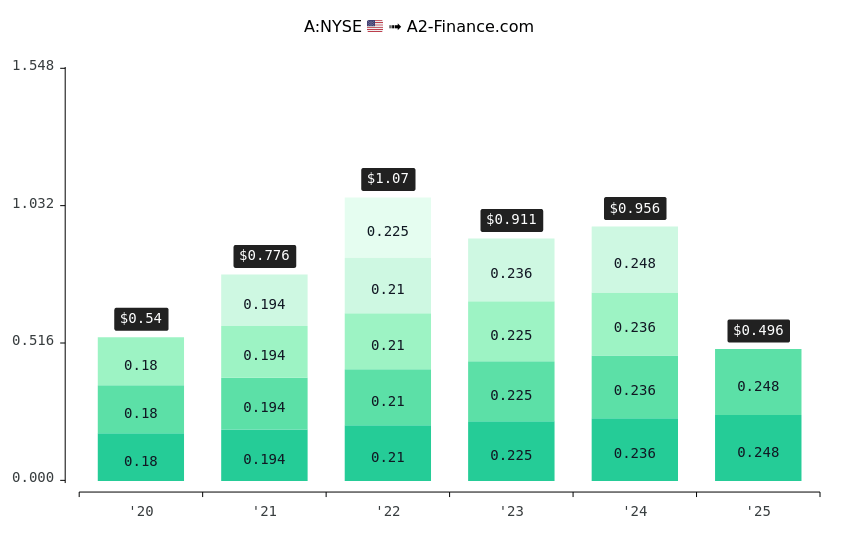

Statistics for 5 years: 2020-2025

- $0.2124 Average Dividend

- $0.8496 Average Dividends per Year

- 0.17% Average Dividend Yield

- 0.67% Average Annual Dividend Yield

- 4.0 Frequency of payments, how many times a year

- 1.0 Duration of growth, number of years

- 100 % Payout Stability

- 20 % Payout Growth Stability

- 77.04 % Dividend Growth, Simple

- 12.10 % Dividend Growth, CAGR

- $0.18 (2020-03-30) Minimum

- $0.248 (2024-12-31) Maximum

| Ex-Dividend Date | Payout Amount | Yield | Pay Date | Declared Date | Record Date | Frequency | Source |

|---|---|---|---|---|---|---|---|

| 2025-07-01 | $0.248 | 0.21% | 2025-07-23 | 2025-05-21 | 2025-07-01 | Quarterly | EOD |

| 2025-04-01 | $0.248 | 0.22% | 2025-04-23 | 2025-02-19 | 2025-04-01 | Quarterly | EOD |

| 2024-12-31 | $0.248 | 0.18% | – | – | – | – | EOD |

| 2024-10-01 | $0.236 | 0.16% | 2024-10-23 | 2024-09-18 | 2024-10-01 | Quarterly | EOD |

| 2024-07-02 | $0.236 | 0.19% | 2024-07-24 | 2024-05-22 | 2024-07-02 | Quarterly | EOD |

| 2024-04-01 | $0.236 | 0.16% | 2024-04-24 | 2024-02-21 | 2024-04-02 | Quarterly | EOD |

| 2023-12-29 | $0.236 | 0.17% | 2024-01-24 | 2023-11-15 | 2024-01-02 | Quarterly | EOD |

| 2023-10-02 | $0.225 | 0.2% | 2023-10-25 | 2023-09-20 | 2023-10-03 | Quarterly | EOD |

| 2023-06-30 | $0.225 | 0.19% | 2023-07-26 | 2023-05-17 | 2023-07-03 | Quarterly | EOD |

| 2023-04-03 | $0.225 | 0.16% | 2023-04-26 | 2023-02-22 | 2023-04-04 | Quarterly | EOD |

| 2022-12-30 | $0.225 | 0.15% | 2023-01-25 | 2022-11-16 | 2023-01-03 | Quarterly | IR |

| 2022-10-03 | $0.21 | 0.17% | 2022-10-26 | 2022-09-21 | 2022-10-04 | Quarterly | IR |

| 2022-07-01 | $0.21 | 0.18% | 2022-07-27 | 2022-05-18 | 2022-07-05 | Quarterly | IR |

| 2022-04-04 | $0.21 | 0.16% | 2022-04-27 | 2022-02-15 | 2022-04-05 | Quarterly | IR |

| 2022-01-03 | $0.21 | 0.13% | 2022-01-26 | 2021-11-17 | 2022-01-04 | Quarterly | IR |

| 2021-10-04 | $0.194 | 0.13% | 2021-10-27 | 2021-09-22 | 2021-10-05 | Quarterly | EOD |

| 2021-07-02 | $0.194 | 0.13% | 2021-07-28 | 2021-05-19 | 2021-07-06 | Quarterly | EOD |

| 2021-04-05 | $0.194 | 0.15% | 2021-04-28 | 2021-03-17 | 2021-04-06 | Quarterly | EOD |

| 2021-01-04 | $0.194 | 0.16% | 2021-01-27 | 2020-11-18 | 2021-01-05 | Quarterly | EOD |

| 2020-10-05 | $0.18 | 0.17% | 2020-10-28 | 2020-09-16 | 2020-10-06 | Quarterly | EOD |

| 2020-06-29 | $0.18 | 0.21% | 2020-07-22 | 2020-05-20 | 2020-06-30 | Quarterly | EOD |

| 2020-03-30 | $0.18 | 0.25% | 2020-04-22 | 2020-03-18 | 2020-03-31 | Quarterly | EOD |

| 2019-12-30 | $0.18 | 0.21% | 2020-01-22 | 2019-11-20 | 2019-12-31 | Quarterly | EOD |

| 2019-09-30 | $0.164 | 0.21% | 2019-10-23 | 2019-09-18 | 2019-10-01 | Quarterly | EOD |

| 2019-07-01 | $0.164 | 0.22% | 2019-07-24 | 2019-05-22 | 2019-07-02 | Quarterly | EOD |

| 2019-04-01 | $0.164 | 0.2% | 2019-04-24 | 2019-03-20 | 2019-04-02 | Quarterly | EOD |

| 2018-12-28 | $0.164 | 0.25% | 2019-01-23 | 2018-11-14 | 2018-12-31 | Quarterly | EOD |

| 2018-10-01 | $0.149 | 0.21% | 2018-10-24 | 2018-09-19 | 2018-10-02 | Quarterly | EOD |

| 2018-07-02 | $0.149 | 0.24% | 2018-07-25 | 2018-05-16 | 2018-07-03 | Quarterly | EOD |

| 2018-04-02 | $0.149 | 0.23% | 2018-04-25 | 2018-03-21 | 2018-04-03 | Quarterly | EOD |

| 2017-12-29 | $0.149 | 0.22% | 2018-01-24 | 2017-11-15 | 2018-01-02 | Quarterly | EOD |

| 2017-10-02 | $0.132 | 0.2% | 2017-10-25 | 2017-09-20 | 2017-10-03 | Quarterly | EOD |

| 2017-06-29 | $0.132 | 0.22% | 2017-07-26 | – | 2017-07-03 | Quarterly | EOD |

| 2017-03-31 | $0.132 | 0.25% | 2017-04-26 | 2017-03-15 | 2017-04-04 | Quarterly | EOD |

| 2016-12-29 | $0.132 | 0.29% | 2017-01-25 | 2016-11-17 | 2017-01-03 | Quarterly | EOD |

| 2016-09-30 | $0.115 | 0.24% | 2016-10-26 | 2016-09-21 | 2016-10-04 | Quarterly | EOD |

| 2016-06-30 | $0.115 | 0.26% | 2016-07-27 | 2016-05-18 | 2016-07-05 | Quarterly | EOD |

| 2016-04-01 | $0.115 | 0.29% | 2016-04-27 | 2016-03-16 | 2016-04-05 | Quarterly | EOD |

| 2015-12-31 | $0.115 | 0.28% | 2016-01-27 | 2015-11-19 | 2016-01-05 | Quarterly | EOD |

| 2015-09-25 | $0.1 | 0.29% | 2015-10-21 | 2015-09-16 | 2015-09-29 | Quarterly | EOD |

| 2015-06-26 | $0.1 | 0.25% | 2015-07-22 | 2015-05-20 | 2015-06-30 | Quarterly | EOD |

| 2015-03-27 | $0.1 | 0.24% | 2015-04-22 | 2015-03-18 | 2015-03-31 | Quarterly | EOD |

| 2015-01-02 | $0.1 | 0.25% | 2015-01-28 | 2014-11-20 | 2015-01-06 | Quarterly | EOD |

| 2014-09-26 | $0.0944 | 0.17% | 2014-10-22 | 2014-09-17 | 2014-09-30 | Quarterly | EOD |

| 2014-06-27 | $0.0944 | 0.16% | 2014-07-23 | 2014-05-22 | 2014-07-01 | Quarterly | EOD |

| 2014-04-09 | $0.0944 | 0.17% | 2014-04-23 | 2014-04-01 | 2014-04-11 | Quarterly | EOD |

| 2013-12-27 | $0.0944 | 0.17% | 2014-01-22 | 2013-11-22 | 2013-12-31 | Quarterly | – |

| 2013-09-27 | $0.0858 | 0.17% | 2013-10-23 | 2013-09-18 | 2013-10-01 | Quarterly | – |

| 2013-06-28 | $0.0858 | 0.2% | 2013-07-24 | 2013-05-23 | 2013-07-02 | Quarterly | – |

| 2013-03-28 | $0.0858 | 0.2% | 2013-04-24 | 2013-01-17 | 2013-04-02 | Quarterly | – |

| 2012-12-27 | $0.0715 | 0.18% | 2013-01-23 | 2012-11-16 | 2012-12-31 | Quarterly | – |

| 2012-09-28 | $0.0715 | 0.19% | 2012-10-24 | – | 2012-10-02 | Quarterly | – |

| 2012-06-29 | $0.0715 | 0.18% | 2012-07-25 | – | 2012-07-03 | Quarterly | – |

| 2012-03-30 | $0.0715 | 0.16% | 2012-04-25 | – | 2012-04-03 | Quarterly | – |

| 2006-11-01 | $1.47139 | 4.32% | – | – | – | – | – |

| Expand | |||||||

Historical Annual Dividends

| Year | Amount | Yield (at avg price) | Avg. Stock Price | Last Stock Price | Yield (at last price) | EPS | Payout Ratio |

|---|---|---|---|---|---|---|---|

| 2025 | $0.50 | 0.42 % | $117 | $120 | 0.41 % | – | – |

| 2024 | $0.96 | 0.69 % | $138 | $134 | 0.71 % | – | – |

| 2023 | $0.91 | 0.72 % | $127 | $139 | 0.66 % | – | – |

| 2022 | $1.1 | 0.78 % | $137 | $150 | 0.71 % | $0.0 | – |

| 2021 | $0.78 | 0.55 % | $142 | $41 | 1.90 % | $3.1 | 25 % |

| 2020 | $0.5 | 0.59 % | $92 | $118 | 0.46 % | $3.3 | 16 % |

| 2019 | $0.67 | 0.89 % | $75 | $85 | 0.79 % | $3.1 | 22 % |

| 2018 | $0.61 | 0.91 % | $67 | $67 | 0.91 % | $2.8 | 22 % |

| 2017 | $0.55 | 0.92 % | $59 | $67 | 0.81 % | $2.4 | 23 % |

| 2016 | $0.48 | 1.10 % | $43 | $46 | 1.05 % | $2.0 | 24 % |

| 2015 | $0.52 | 1.30 % | $40 | $42 | 1.23 % | $1.7 | 30 % |

| 2014 | $0.28 | 0.53 % | $53 | $41 | 0.69 % | $3.1 | 9 % |

| 2013 | $0.35 | 0.73 % | $48 | $57 | 0.62 % | $2.9 | 12 % |

| 2012 | $0.29 | 0.70 % | $41 | $41 | 0.70 % | $3.1 | 9 % |

| 2006 | $1.5 | 4.32 % | $34 | $34 | 4.32 % | $1.7 | 87 % |

| Expand | |||||||

Previous / Next Dividends

On this page, you can find information about the latest dividend payment by Agilent Technologies company and the forthcoming one. Sometimes the information about the future might be not yet available since the dividends have not been declared or approved. In this case, we will share a forecast — but only if we have such data (you can also check this information in the DivPort section). In the right part, you can calculate how much you would earn in dividends if you had a certain number of shares.

Stock Price Recovery History

| Ex-Dividend Date | Payout Amount | Stock Price | Days for Stock Price to Recover |

|---|---|---|---|

| 2025-07-01 | $0.248 | $120.45 | - |

| 2025-04-01 | $0.248 | $114.05 | 91 |

| 2024-12-31 | $0.248 | $134.34 | - |

| 2024-10-01 | $0.236 | $146.56 | - |

| 2024-07-02 | $0.236 | $125.78 | 91 |

| 2024-04-01 | $0.236 | $145.56 | 183 |

| 2023-12-29 | $0.236 | $139.03 | 94 |

| 2023-10-02 | $0.225 | $110.9 | 88 |

| 2023-06-30 | $0.225 | $120.25 | 182 |

| 2023-04-03 | $0.225 | $137.86 | 270 |

| 2022-12-30 | $0.225 | $149.65 | - |

| 2022-10-03 | $0.21 | $126.38 | 88 |

| 2022-07-01 | $0.21 | $119.21 | 94 |

| 2022-04-04 | $0.21 | $134.81 | 270 |

| 2022-01-03 | $0.21 | $156.48 | - |

| 2021-10-04 | $0.194 | $152.36 | 1 |

| 2021-07-02 | $0.194 | $148.82 | 4 |

| 2021-04-05 | $0.194 | $130 | 1 |

| 2021-01-04 | $0.194 | $118.64 | 1 |

| 2020-10-05 | $0.18 | $103.12 | 2 |

| 2020-06-29 | $0.18 | $87.29 | 1 |

| 2020-03-30 | $0.18 | $72.67 | 7 |

| 2019-12-30 | $0.18 | $84.9 | 1 |

| 2019-09-30 | $0.164 | $76.63 | 32 |

| 2019-07-01 | $0.164 | $75.78 | 2 |

| 2019-04-01 | $0.164 | $81.56 | 2 |

| 2018-12-28 | $0.164 | $65.96 | 3 |

| 2018-10-01 | $0.149 | $71.26 | 1 |

| 2018-07-02 | $0.149 | $61.47 | 3 |

| 2018-04-02 | $0.149 | $64.43 | 1 |

| 2017-12-29 | $0.149 | $66.97 | 4 |

| 2017-10-02 | $0.132 | $64.87 | 1 |

| 2017-06-29 | $0.132 | $58.8 | 1 |

| 2017-03-31 | $0.132 | $52.87 | 3 |

| 2016-12-29 | $0.132 | $45.64 | 5 |

| 2016-09-30 | $0.115 | $47.09 | 3 |

| 2016-06-30 | $0.115 | $44.36 | 1 |

| 2016-04-01 | $0.115 | $40.31 | 12 |

| 2015-12-31 | $0.115 | $41.81 | 112 |

| 2015-09-25 | $0.1 | $34.45 | 7 |

| 2015-06-26 | $0.1 | $40.02 | 18 |

| 2015-03-27 | $0.1 | $41.11 | 3 |

| 2015-01-02 | $0.1 | $40.56 | 6 |

| 2014-09-26 | $0.0944 | $56.5 | 3 |

| 2014-06-27 | $0.0944 | $57.5 | 4 |

| 2014-04-09 | $0.0944 | $55.57 | 33 |

| 2013-12-27 | $0.0944 | $57.1524 | 158 |

| 2013-09-27 | $0.0858 | $51.6141 | 91 |

| 2013-06-28 | $0.0858 | $42.7468 | 91 |

| 2013-03-28 | $0.0858 | $41.957 | 92 |

| 2012-12-27 | $0.0715 | $40.6275 | 91 |

| 2012-09-28 | $0.0715 | $38.4381 | 90 |

| 2012-06-29 | $0.0715 | $39.2279 | 181 |

| 2012-03-30 | $0.0715 | $44.4963 | 546 |

| 2006-11-01 | $1.47139 | $34.0795 | 1976 |

| Expand | |||